Freight rates rose throughout 2020, and we have yet to see the trend reverse with any consistency. The reason can be pinned on several factors, which is why we are continuing to analyze some of the major contributing sectors driving up rates.

This week we will focus on retail demand, which has continued to beat year-over-year comparisons for the better part of the last year.

Consumer spending during COVID has propelled the freight market to previously unseen highs. When combined with what is occurring in other sectors, its effect on CPG shippers has been pronounced.

Because of increased freight volume, CPG shippers have been subjected to tighter than typical capacity and rising freight rates.

While this somewhat relaxed a bit in the late winter and early spring, retail sales substantially increased in March. Those numbers, along with others, could send the market and freight rates to previously unseen highs.

Let’s take a look at how retail demand is affecting CPG shippers in the trucking market.

Retail Sales Jump Post-Quarantine

As alluded to above, retail sales increased sharply last year following the country’s widespread quarantine measures in the spring. As things began to open back up and direct stimulus payments cleared banking accounts, demand skyrocketed, adding volume to the freight market that had been lacking during the initial response to COVID-19.

After a drastic fall in April of 2020, retail sales mounted a significant comeback for the remainder of the quarter. According to an article published by CNBC, retail sales grew roughly 18 percent, which more than doubled estimates.

This trend did not slow much after, aside from a few blips. According to the analysis of the Department of Commerce’s year-end figures, total retail sales increased by nearly 7%. They grew from $3.78 trillion in 2019 to $4.04 trillion in 2020, despite a year marred by the pandemic. This growth represents the most significant single-year increase since 1999.

Shoppers collectively reallocated much of their spending, shifting from experiential purchases, like travel or dining, to consumer goods. Because many brick and mortar locations were reduced in operating capacity or consumers did not feel comfortable shopping in person, a massive number of these transactions occurred online.

Channel Changes Add Volume, Drive Up Freight Rates

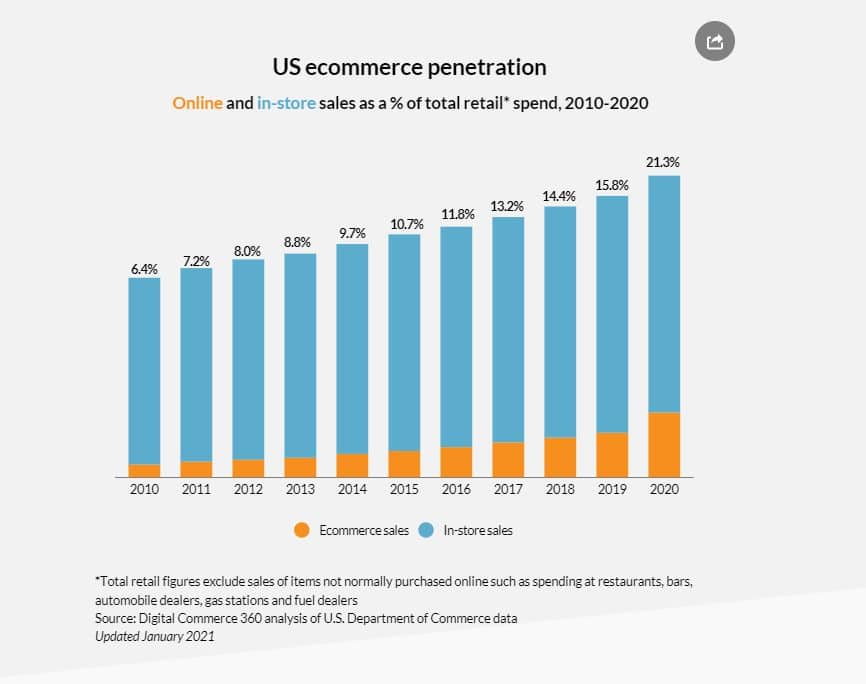

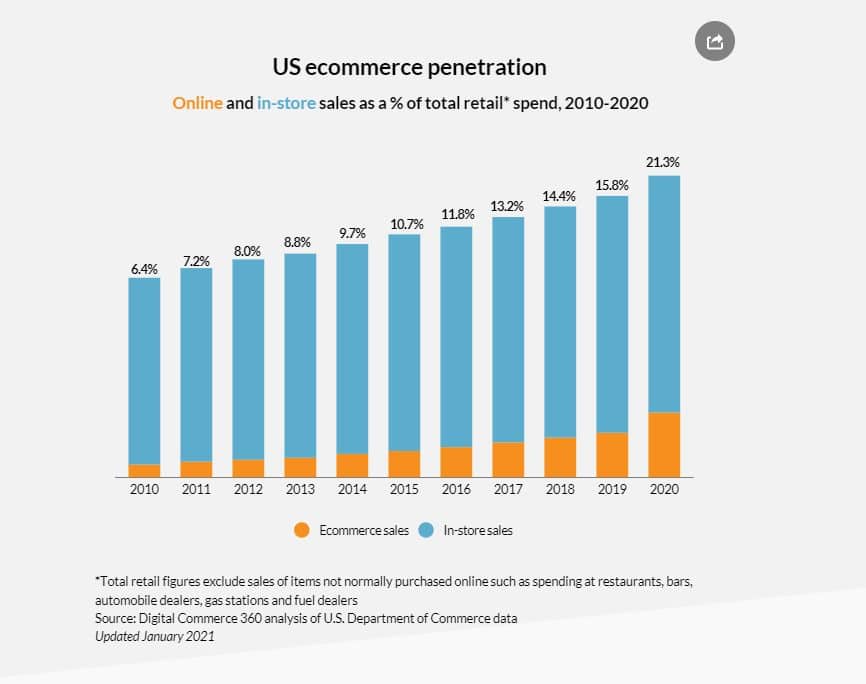

Ecommerce emerged as a winner from the aftermath of the pandemic, touting an additional $174.87 billion in revenue compared to 2019. This boost truncated some projected growth timelines of the channel. It was estimated that e-commerce was not to reach the above figures until 2022.

Furthermore, it was online shopping that was the sole driver of increased retail numbers. According to Digital Commerce 360, “online sales accounted for 101% of all gains in retail in 2020. This means sales through all other channels—stores, catalogs and call centers—declined.”

These COVID-induced stats mark the first time that US e-commerce numbers accounted for all retail sales gains. The previous high was in 2008 when e-commerce accounted for 63.8% of all retail sales growth.

This surge doubled e-commerce’s prevalence as a purchasing channel. In the figure below, we see online shopping compared to total retail sales. A previously steady increase was replaced by rapid growth last year.

While the pandemic undoubtedly fuels these numbers, experts do not see these trends subsiding even after COVID-19.

All this online ordering does more than boost retail sales figures and suppliers’ bottom lines. It also adds a substantial amount of freight volume to the marketplace as CPG brands must get their products to retailers or directly to end customers to meet increased demand.

The growth rate in this sector over the past year has left many shippers and carriers alike struggling to keep up with demand. That has driven up freight rates across every market.

CPG Shippers Should Prepare for More of the Same

As we head into an already busy season for freight, the above trends will apply more pressure than past summer peak seasons.

Produce is already diverting capacity and retail sales, including food services, increased 9.8% sequentially in March, according to Census Bureau data. These figures represent a 27.7% increase in sales for the month and 14.3% for the first quarter in year-over-year comparisons. This jump was again closely tied to stimulus payments that went out in Q1.

These elevated figures will not only add more freight to the marketplace in the immediacy, but they will also require inventory restocks and imports to accommodate them.

In an interview with American Shipper, Amit Mehrotra, head transportation analyst at Deutsche Bank, stated that he believes that “the US inventory restocking cycle is nowhere close to over and import demand is certainly not about to fall off a cliff.”

With congested conditions already plaguing ports along the West Coast, this restock cycle could increase the severity of the situation. And as more imports are on deck, shippers should expect capacity challenges to persist.

Work with a True Logistics Partner to Mitigate Challenges with Freight Rates

Shippers will potentially see some relief on the back half of the year as truck manufacturers increase output to give carriers additional capacity to handle the heightened volume. Moreover, demand for truck driving school is hitting a fever pitch and will add more drivers to the labor pool, which currently sits about 50,000 short of demand.

Until then, it will benefit shippers to work with a dedicated logistics partner to ensure conditions do not jeopardize profitability. A true freight partner can help your organization accurately forecast costs and find more favorable pricing through consolidation or mode optimization practices.

To see the difference a true logistics partner can make, reach out to Zipline Logistics today.

The post Why Are My Freight Rates Increasing? Retail Demand Remains Elevated appeared first on Zipline Logistics.